Student loan forgiveness up close

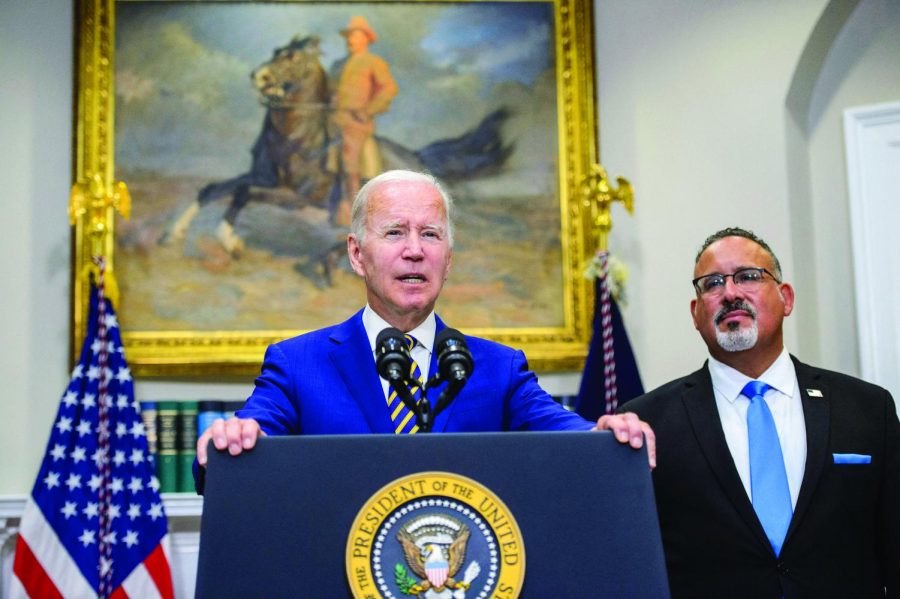

President Joe Biden unveiled his intentions to forgive student debt on Aug. 24. Since then, a multitude of questions have arisen regarding who is applicable, why it is necessary and the legality of the program.

Oct 24, 2022

What students need to know, from applications to lawsuits

On Aug. 24, President Biden announced to the country that he was planning on forgiving student loans but did not have a clear set of guidelines on who was eligible for relief and when the application would be open.

One week ago, on Monday, Oct. 17, the Biden administration announced that the form was officially available for people to fill out to see if they were eligible for student debt relief.

Why is this the time for mass student debt forgiveness? Many across the country are asking, and the response that the Biden administration has given is that too many young Americans are being weighed down by an astronomical amount of debt when graduating college that prior generations hadn’t faced.

According to the CollegeBoard, in the last 40 years, the cost of both private and public four-year institutions for post-secondary education have nearly tripled after taking inflation adjustments into account.

At one time, Pell Grants covered up to 80 percent of the cost of a four-year public college degree for many low-income middle-class working families. Today, a Pell Grant does not quite cover a third.

According to the U.S. Department of Education (ED), the average undergraduate student graduates their institution with about $25,000 in debt.

The University of Northern Iowa has its fair share of students with debt problems, like many universities across the nation. The 2021 UNI Financial Aid Annual Report shows that roughly 67.5 percent of undergraduates graduate with debt and 32.5 percent without. The average student indebtedness at UNI is $24,593. When you include transfer students, the average goes down to $22,966.

In the 2020-2021 school year, roughly 4,826 students borrowed federal and private loans with the average student loan being borrowed at $7,713. Roughly 8,412 students of the 2020-2021 school year received some sort of aid from the university. With just over 67 percent of graduating students leaving with debt, there are definitely many students at this university who will be graduating soon who are curious as to how this will affect them.

After talking to Jack Murphy, a financial aid counselor at UNI, many students at UNI are interested in this debt relief.

“We had a big surge in calls in the weeks following the announcement of the student loan debt relief plan. Many asking if it was going to be applicable to them and other questions on how it will work,” he said. Murphy also provided the information about the 2021 UNI Financial Aid Report.

The biggest question on everyone’s mind besides if they were eligible or not for forgiveness was how much forgiveness in student debt would they be given. According to the studentaid.gov website, you can be eligible for up to $20,000 in loan forgiveness if you received a Pell Grant. If you had not received a Pell grant through the government, you’re only eligible for up to $10,000 in loan forgiveness.

All of this also depends on whether you meet income requirements. You are eligible for aid if you meet the following requirements:

If you did not file taxes and made less than the required income to file federal taxes, filed single or married and filed your taxes separately and made under $125,000. Married, filed your taxes jointly, head of household or you are a qualifying widow(er) and made less than $250,000. If your parents claimed you as a dependent on their taxes then you would just have to see what category your parent/s fell under when they filed their 2020 or 2021 taxes.

The following loans are eligible for relief if the student loans were disbursed on or before June 30 of 2022: William D. Ford Federal Direct Loan (Direct Loan) Program loans, Federal Family Education Loan (FFEL) Program loans held by ED or in default at a guaranty agency, Federal Perkins Loan Program loans held by ED, Defaulted loans (includes ED-held or commercially serviced Subsidized Stafford, Unsubsidized Stafford, parent PLUS, graduate PLUS and Perkins loans held by ED.

Over the last few weeks, the Biden administration has been fighting several different lawsuits around the country trying to stop the student loan forgiveness plan with each getting rejected, including Associate Justice of the Supreme Court Amy Coney Barrett rejecting to hear an appeal in Wisconsin to stop the relief plan. But on Friday, Oct. 21 the Eighth Circuit Court of Appeals, located in St. Louis, had an appeal filed. As a result, it has temporarily blocked any student loan forgiveness. The Biden administration has been ordered not to act on said program while it is being considered in the appeal court.

This, however, does not stop anyone from applying to the program–22 million borrowers have already applied to the program in the week since its launch.

When applying for this program, people should be aware of scams as many people will try to take advantage of this situation. As the Federal Student Aid website says, “You might be contacted by a company saying they will help you get a loan discharge, forgiveness, cancellation or debt relief for a fee. You never have to pay for help with your federal student aid. Make sure you only work with ED and our loan servicers, and never reveal your personal information or account password to anyone.”

If you believe that you have been contacted by a scam, you can report it to the Federal Trade Commission by calling 1-877-382-4357 or by visiting reportfraud.ftc.gov For any other questions you may have about the loan forgiveness process or application you can visit studentaid.gov for further information.