LTE: GOP tax plan will lead to tax increases

Steve Corbin, professor emeritus of marketing, pens a letter to the editor criticizing the Republican party’s proposed tax plan.

Nov 13, 2017

Editor’s note: the following letter to the editor was submitted by Steve Corbin, professor emeritus of marketing at UNI.

America’s Republican-controlled Congress promises their proposed tax cut reform plan will pay for itself through economic growth. This assertion lacks any historical precedent.

No politician of any stripe has or ever will admit that tax cuts are always followed by tax increases.

Presidents John F. Kennedy (Dem.) and Lyndon Johnson (Dem.) reduced taxes in 1962 and 1964; taxes were raised in 1966 and 1968.

In 1981, President Ronald Reagan (Rep.) lowered taxes, and they were increased in 1982, 1983 and 1984. President George W. Bush (Rep.) enacted tax cuts in 2001 and 2003; taxes were increased in 2013.

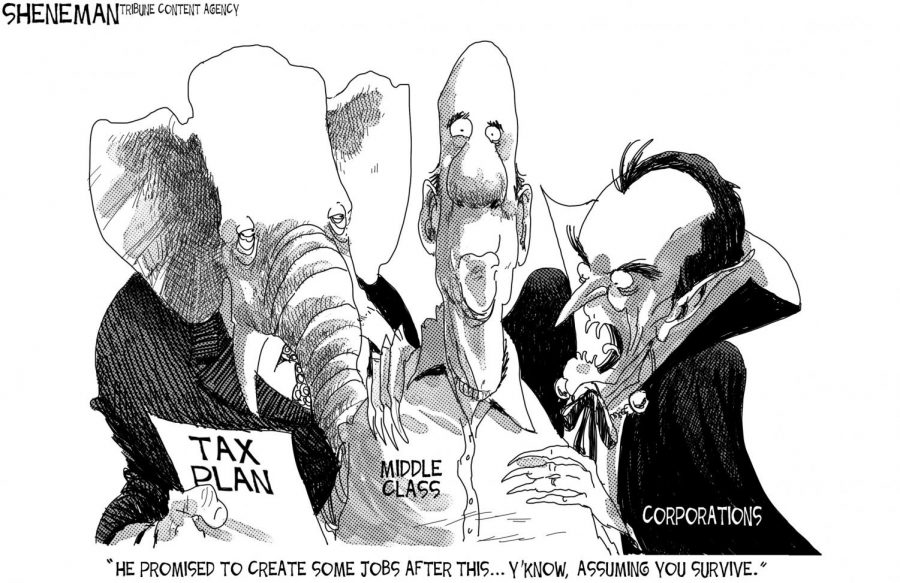

Who pays for the inevitable increased taxes? It never has been placed on the back of corporations.

You and I will be saddled with paying more taxes. Knowing this fact, Congress needs to give serious attention to a more grandiose problem than their current smoke and mirrors tax reform plan.

The current GOP tax proposal will add, according to the Congressional Budget Office, $1.7 trillion to our already out-of-control fiscal debt; currently $20.4 trillion (www.us-debt-clock.org).

To put this number into perspective, each child, teenager and adult must pony up $63,000 to erase our deficit — an increase of $3,000 from last year.

Our public debt equals 77 percent of America’s gross domestic product (GDP). Economists note when our deficit gets to 90 percent of GDP, our financial status will be equivalent to bankrupt Argentina, Belarus, Belize, Greece, Jamaica, Ukraine and Venezuela.

Why should Iowans care about the deficit?

Thirty-three percent of Iowa’s $22.7 billion total budget comes from Uncle Sam.

Unless Congress gets their act together and puts federal deficit control before tax reformation, Iowa will receive fewer federal resources for important issues like transportation, education, Medicaid, energy efficiency projects, nutritional programs, city revitalization and child welfare services, to name a few.

None of our previous 44 presidents can be blamed for our deficit problem.

Why?

The federal budget is established by the U.S. House and Senate, not the President’s office.

The real culprits for our ugly predicament include all Senators and Representatives elected since 1974 who have approved out-of-control spending. This includes Senators Grassley and Ernst and Representatives Blum, King, Loebsack and Young; their 10 percent approval rating is proper.

Without budget discipline by Congress, America will have a Value Added Tax, higher interest rates, uncontrolled inflation, decline of private investments and slower economic growth.

Before enacting any tax reform package, Congress must first focus on our deficit and do two things:

First, support the Fiscal Responsibility Act, which prohibits Congress from passing budgets that would increase the national debt as a share of the overall economy, except in cases of war, disaster or a recession.

FYI: 76 percent of Democrats, 87 percent of Republicans and 78 percent of independents support this initiative (Cohen Research Group).

Secondly, support the No Budget-No Pay Act, whereby if the spending appropriations process is not completed by the start of a new federal fiscal year, congressional pay ceases as of Oct. 1 and salaries are not restored until the appropriations is completed.

FYI: 82 percent of Republicans and Democrats and 79 percent of independents support No Budget, No Pay (Cohen Research Group).

If our 535 elected representatives to Washington, DC would enact these two measures, we could reign in our public debt and then Congress could propose a well thought-out tax reform plan.

Unfortunately, our legislators have ignored our federal deficit and tax reform history, putting the cart before the horse.

Knowing you are now being hoodwinked by the promise of a tax cut, don’t act dumbfounded when your personal taxes increase. Without controlling our $20.4 trillion federal deficit, tax cuts followed by tax increases will occur — guaranteed.