House GOP tax hike on graduate students raises concerns

Dec 4, 2017

As the Republican effort to pass the largest tax reform package in decades continues, several details of the House bill, passed on Nov. 16, have come under intense scrutiny from the academic community due to its projected impact on graduate students.

Iowa’s three public university presidents co-authored a letter to every member of Iowa’s federal delegation — Senators Chuck Grassley (R) and Joni Ernst (R) and Representatives Rod Blum (R), Dave Loebsack (D), David Young (R) and Steve King (R) — to express concern over several provisions in the House version of the bill.

The letter stated: “There are provisions of the bill that would discourage students from pursuing higher education, increase the costs of students and their families and jeopardize our campuses’ ability to operate cost-effectively.”

Several provisions have come under scrutiny due to their impact on higher education, but the provision that has received the most attention is the repeal of Section 117(d) of current law. Repeal of Section 117(d) would remove the tax-exempt status of tuition waivers, significantly increasing the tax burden on Iowa college students, disproportionately affecting graduate students.

Many students utilize tuition waiver and stipend programs to help finance their graduate education. In exchange for conducting or assisting in research and/or teaching, students receive a tuition waiver, which covers part of/the entirety of a student’s tuition, and may also receive a stipend to help pay for living costs.

Assistant to the President Andrew Morse detailed some of the waivers that UNI offers in an e-mail to the NI.

“UNI does offer tuition waivers for out of state students, and these put the out-of-state student’s tuition at the in-state rate,” Morse stated. “To qualify, the student must hold at least a half-time Graduate Assistantship (GA) for the entire semester. GAs work 20 hours per week in a research, teaching or administrative position […] The average stipend for a half-time GA is $2,658 per semester, and $5,450 per semester for a full time GA.”

Currently, an out-of-state graduate student working a full time GA would receive a roughly $10,474 tuition waiver from the university to cover the difference between out of state and in state tuition. The graduate student would also receive a $5,450 stipend.

These two allotments, totaling approximately $16,000, would be fully taxable under the House Republican plan. Under current law, only the stipend is considered taxable income. According to CNBC, the House bill will increase taxes for graduate students by roughly 400 percent.

Regarding Section 117(d), the letter read: “The provision would affect more than 8,000 graduate and professional students across Iowa’s public universities. Repealing 117(d) would increase tax liability per student by an estimated $3,000-$10,000 depending on the terms of the employment arrangement at each of our public universities. At UNI, for example, full-time graduate assistants receive an average stipend of $5,450 per year; increasing their tax liability would result in a net loss of income.”

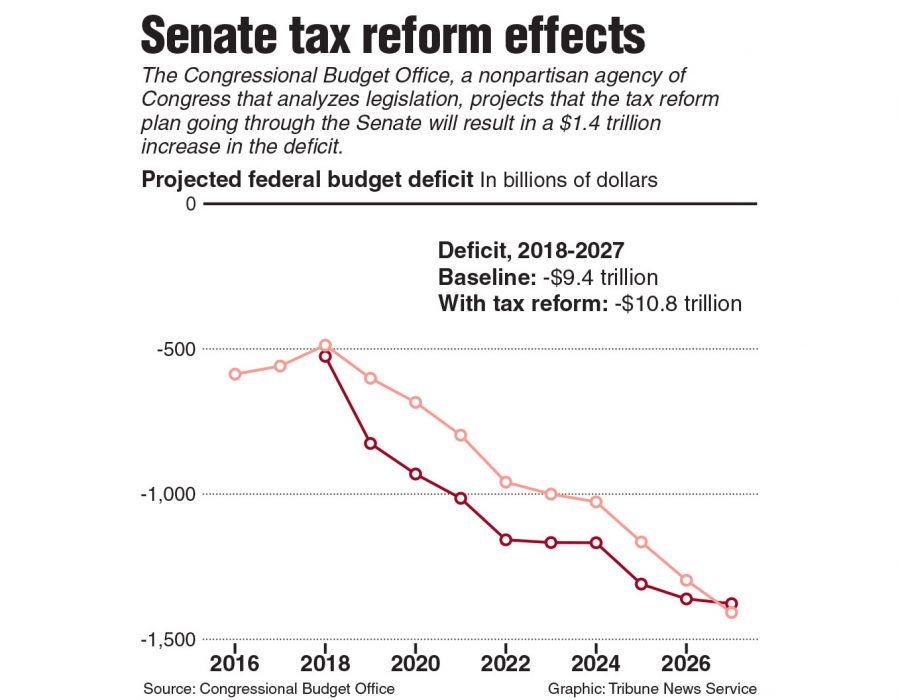

The American Council on Education (ACE) also expressed concern over the bill’s impact on higher education, stating in a letter to Representatives Kevin Brady and Richard Neal: “This legislation, taken in its entirety, would discourage participation in postsecondary education, make college more expensive for those who do enroll and undermine the financial stability of public and private, two-year and four-year colleges and universities. According to the Committee on Ways and Means summary, the bill’s provisions would increase the cost to students attending college by more than $65 billion between 2018 and 2027. This is not in America’s national interest.”

The provision repealing Section 117(d) exists only in the House of Representatives bill that was passed last month; the provision was not present in the Senate bill that was passed last week.

Another provision, over which the presidents expressed concern, is the repeal of the Student Loan Interest Deduction (SLID). The ACE letter was alarmed with this provision, reading: “Under current law, any individual with income up to $80,000 (or $160,000 on a joint return) repaying student loans can currently deduct up to $2,500 in student loan interest paid. In 2014, 12 million taxpayers benefited from SLID. Eliminating this provision would mean that, over the next decade, the cost of student loans for borrowers would increase by roughly $24 billion.”

Major Republican-spearheaded tax reform is all but guaranteed at this point. After the passing of the Senate bill, the House and Senate will now work together to create a final bill. After both chambers agree on a final product, the bill will move on to President Trump’s desk, where he is expected to sign the bill into law. Congressional Republicans hope to have the bill to Trump by Christmas. The bill represents the first major legislative victory of the Trump era.

Whether the provisions that increase the tax burden on college students will be retained in the final bill is yet to be seen.

“UNI has been working diligently to address the implications of the Tax Cuts and Jobs Act pending before the 115th Congress,” Morse said.

According to Morse, in addition to the presidential letter that was sent to Iowa’s federal delegation, UNI has been in contact with tax counsels for Senator Grassley and Ernst, and UNI’s Office of Governmental Relations has been in contact with the Iowa federal delegation.